We encourage all of those who are part of our church family to give — not out of obligation but out of a spirit of worship. Generosity is not something God wants from you, it is something God wants for you. Your gifts allow God's work to be done through Grace across the street and around the world.

Grace Church Funds:

• Church Ministries: General fund to support Grace Church ministries and operations that take place at all of our locations and online.

• Bridge Fund: Fund designed to assist those within the Grace Family in times of financial distress or emergencies. Provides a temporary “bridge” for the individual/family to get back on their feet.

• Missions: Fund to support our mission of making disciples of Jesus across the street (equip and engage the Grace family to reach and disciple people in their spheres of influence) and around the world (reach beyond our culture with the Gospel to make disciples of those who have never heard).

• Re:New Fund: Fund primarily be used to transform and grow Grace Beginnings, Grace Kids, and NXT Student ministries as we make outrageous efforts to reach and disciple those 0 to 18. Funds will also be available for broader facility maintenance and infrastructure improvements as needed.

• Interested in Gifting Stock?

Securely Give Online

Your information is held securely by an SSL encrypted connection. This information will remain private and will never be given away to third parties, other than to process your scheduled contributions.

Contact Us

Please contact Accounting at 952-224-3005 or if you have any questions.

Grace Church is an accredited member of the

Evangelical Council for Financial Accountability.

Why We Give

"Each one must give as he has decided in his heart, not reluctantly or under compulsion, for God loves a cheerful giver." - 2 Corinthians 9:7

Give Online

Here are some quick steps to give online:

- Visit grace.church/give to set up your automatic gift.

- Choose your location. This will take you to our secure provider on pushpay.com.

- Enter the amount you would like to give.

- Select your Gift Type/Frequency, and the fund to which you want it directed.

- After you set up your gift, you will be prompted to complete the setup of your new account.

Note About Giving to Multiple Funds

This system supports giving to more than one fund a little differently than our previous systems. To do so, make your first gift to one fund and follow the process all the way through.

On the gift confirmation screen, you will be given an option to “Give Again.” This will allow you to give to another fund without re-entering your personal or payment information. Repeat this as many times as needed.

Giving Stations

You may drop checks or cash in a giving station at either location.

Stocks

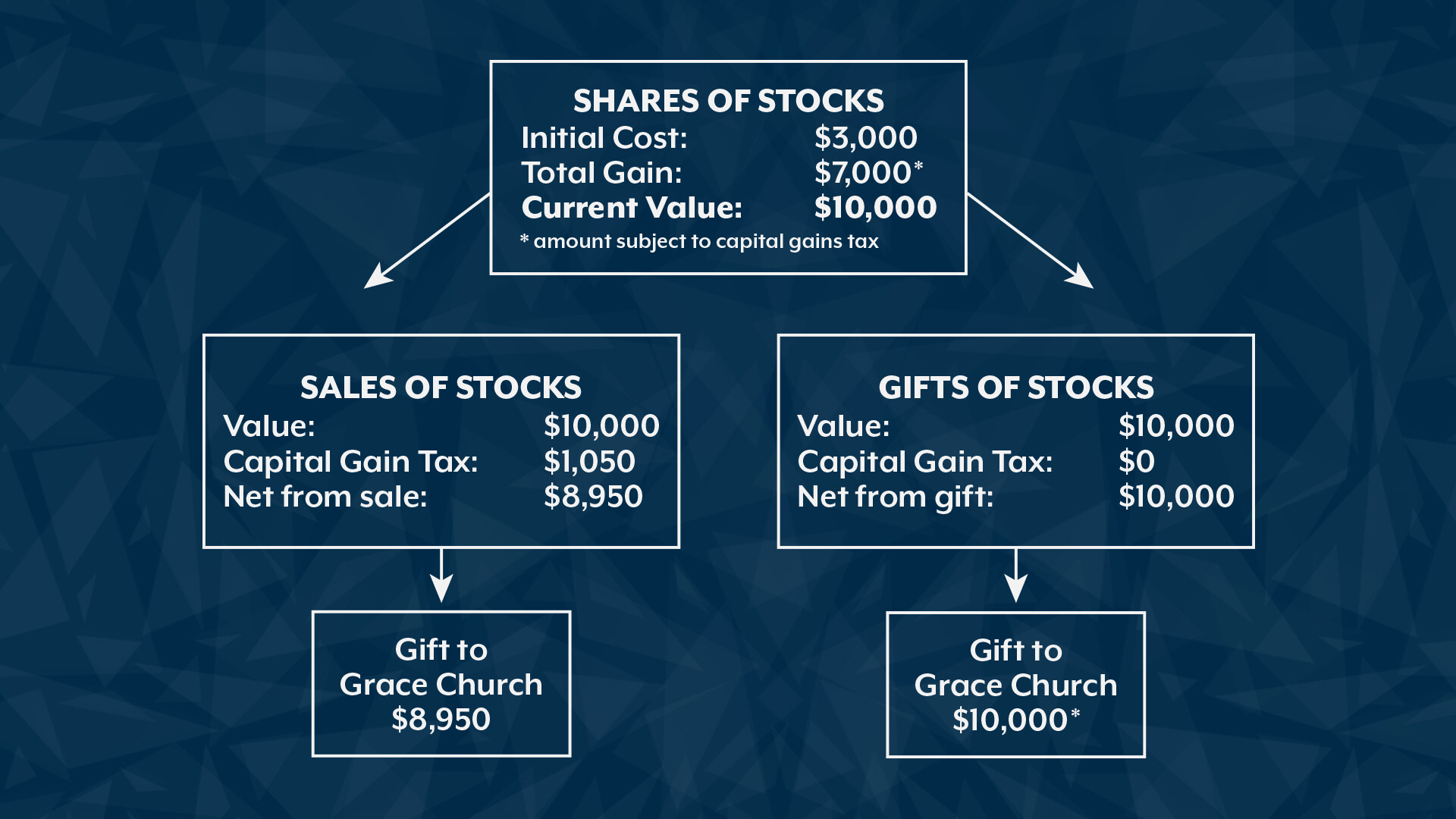

A gift of appreciated stocks or property. Donate appreciated stocks or property — you may avoid capital gains tax and be positioned to give more to ministry than if you sold the asset and donated the profits, as seen in the graphic below. Click here for more information about giving stocks.

In this scenario, $1,050 in capital gains tax on the appreciated value is avoided by donating the appreciated stock directly to Grace Church.

*You take a deduction for the full market value ($10,000) of the stock you’ve donated, not just a deduction of $8,950.

IRA Rollover

A rollover gift from your IRA. If you’re 70-1/2 years or older, make a rollover gift from your IRA. You can give up to $100,000 without adding a penny to your taxable income.

CARES Act Tax Implications

- Individual Itemizers | Givers who itemize deductions are able to increase giving to the church for cash gifts made in 2020. Unique to this year only, you are able to deduct up to 100% of your 2020 adjusted gross income.

- Individual Non-Itemizers | Givers who take the standard deduction are able to deduct up to $300 for cash gifts made in 2020, in addition to the standard deduction.

- Corporations | The CARES Act also increases the limit on deductible corporate charitable gifts from 10% to 15% of the corporation's taxable income. The additional 15% deduction is for cash gifts only.

Please seek the advice of legal counsel, a qualified accountant, and/or financial advisor to determine if any of these tax-advantaged strategies are appropriate for you and your individual income tax circumstance.